Which text might not be in its finally mode that can end up being updated or revised in the future. Reliability and you can availableness ming ‘s the musical number.

You can anticipate one to financial rates will be shedding today after the Government Put aside cut interest rates by 1 / 2 of a time last day. However, this week, home loan prices sprang high, and their greatest raise just like the sley, NPR’s personal loans correspondent. Hello, Laurel.

RASCOE: Therefore home loan prices ran right up recently, regardless of if interest rates is actually down. Exactly what around the globe is being conducted right here?

Which is excellent information to own consumers that maybe not got much to choose from

WAMSLEY: That is true. The latest investigation out of Freddie Mac indicated that the average 30-12 months financial rate got increased to 6.3% this week. That’s regarding the 25 % section higher than it actually was 2 weeks ago. That’s most likely an unwanted wonder on the people that are finally coming off the latest sidelines to start looking for a home. So why is this happening? It is because financial prices aren’t associated with the latest Fed’s interest, but instead, they realize a different sort of count. It give with the a beneficial ten-seasons treasury thread, hence ran large recently for a number of factors.

WAMSLEY: Zero, it’s determined by the Fed, but it is maybe not set by Given. And now have understand that your neighborhood loan providers which indeed make you their home loan need coverage its costs and also make income, so they really add their fee ahead.

WAMSLEY: Yes, that will be the big picture for taking off this still. Despite which uptick, financial rates be than simply an entire area lower than they was now this past year, and lots of men and women are capitalizing on you to. These are generally refinancing the mortgages if they ordered a house on the last few decades whenever costs were higher. The low pricing indicate they are able to potentially save a lot of money 30 days.

RASCOE: Which appears like financial cost try sorts of a moving address right now. Is there any feeling of where they accept? In fact it is the things i actually want to discover. In which will they be supposed?

WAMSLEY: Me and you one another. So i presented one to concern so you’re able to Lawrence Yun, the principle economist in the National Connection out-of Real estate professionals, and you can some tips about what he said.

LAWRENCE YUN: I believe the newest regular is generally six% financial price, which our company is very next to. When we is fortunate, maybe we get so you’re able to 5 step 1/dos percent home loan rates.

WAMSLEY: Otherwise we are able to be unfortunate, the guy told you, as well as the speed dates back up into the 7%. And this sort of forecasting is hard, even for economists. But looking at numerous predicts, several has actually prices becoming over six% from stop associated with the season and you can dropping in order to throughout the 5.8 the coming year. When you perform need it property, you may not should hold off to find out if cost have a tendency to get rid of ’cause if they carry out, you can usually re-finance so you can a diminished rate. However, if it increase, it simply will get more difficult to purchase a house.

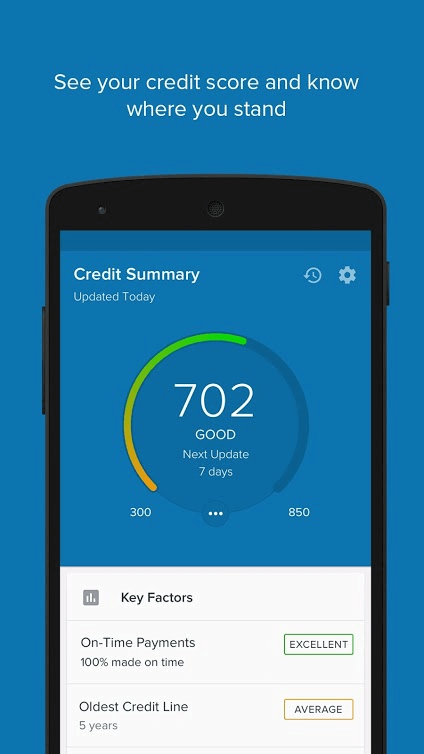

Together with certain home loan speed that you’d get is based on your own facts, like your credit rating additionally the proportions and type away from mortgage that you will be getting

WAMSLEY: Well, will still be a small very early to share with, once the to acquire a property can take weeks out of searching to truly closing. However, there are lots of indications your all the way down rates is actually moving anything a little while loose.

WAMSLEY: Really, as an example, more folks is checklist their houses available. Discover 23% even more existing homes in the market than just there had been per year in the past. And there is enough new virginia homes, as well. And you can household providers are homebuyers also, very men and women group was entering the field in the future. And several sellers have likely already been awaiting home loan pricing so you’re able to miss because it is hard to stop trying this new super-lowest costs that many locked in the in pandemic, even though these include outgrowing its latest household. After which another sign would be the fact applications getting mortgages has actually ticked up a bit, 8% higher than a year ago, which also shows that more individuals are preparing to pick an effective house.