Not all service representative otherwise Seasoned provides primary borrowing from the bank or a keen 800 credit history. In fact an extremely small fraction from People in america do so get. Thank goodness Virtual assistant loans is actually fairly flexible with regards to borrowing from the bank rating. For this reason it autonomy along with the power to purchase a home with no currency down renders Virtual assistant a good investment alternative. So a greatest concern that comes right up throughout the app interviews are What’s the minimum credit rating having Va mortgage?.

Minimal Credit score to own Va Financing

To start with, remember that an effective Va financing credit rating is not all that things. By way of example, anybody possess a great 680 credit rating however, got a foreclosures 30 days before. But credit ratings is actually a requirement as they are a first rung on the ladder. For each and every Va financial has actually different standards, however, the lowest credit score to have Va financing try 600. So if you features a great 600 credit history, can you automatically get approved? Not necessarily. Think of, credit rating is a kick off point however it is certainly it is possible to which have reasons and you can founded a good credit score.

The great thing on the a good Va financing and you can the underwriters are not the borrowing from the bank must inform you towards credit file. So what if that a veteran provides a 620 credit history and just features 1 education loan revealing with the borrowing from the bank recently. In the event it you to borrowing from the bank trading line has been repaid while the arranged, alternative borrowing from the bank may help. Complementing most other borrowing from the bank sources not found on the credit report will get tell you an ability to repay. There is a large number of alternative borrowing from the bank solutions given below

- Rent

- Tools. Fuel, liquid, electric, cord, cellphone

- Insurances. Automobile, clients, wellness, disability

- University university fees

- Mobile

- Lease to have accounts

- Consistent checking account places

- Quick store membership

- On the internet characteristics: Recently i put Xbox 360 Real time to own credit

Keep in mind that a lot more than option credit supply paid off right from a salary dont amount. Solution borrowing from the bank need to be repaid beyond a paycheck. Therefore payroll subtracted medical health insurance wouldn’t number.

Previous Virtual assistant Financing Achievements Facts Previous Bankruptcy & Put Solution Credit

Because of it Experienced, an acceptance is practical. He’d problems before, got a great reason for what taken place, and you may ended up lso are-built borrowing. There have been anything else accustomed assist have the acceptance since the really. The biggest is actually grossing up the Va handicap money that is nontaxable. Nontaxable money particularly Va handicap is not taxed by national. Very in fact in such a case, playing with a high figured lower their financial obligation ratio contained in this rule details. You can now close an 800 credit rating, strong borrower. But we like providing Veterans and you will services people with knowledgeable a hardship. We are going to put in the most work to help you purchase a home regardless of if hardly at the very least credit history to own Va financing.

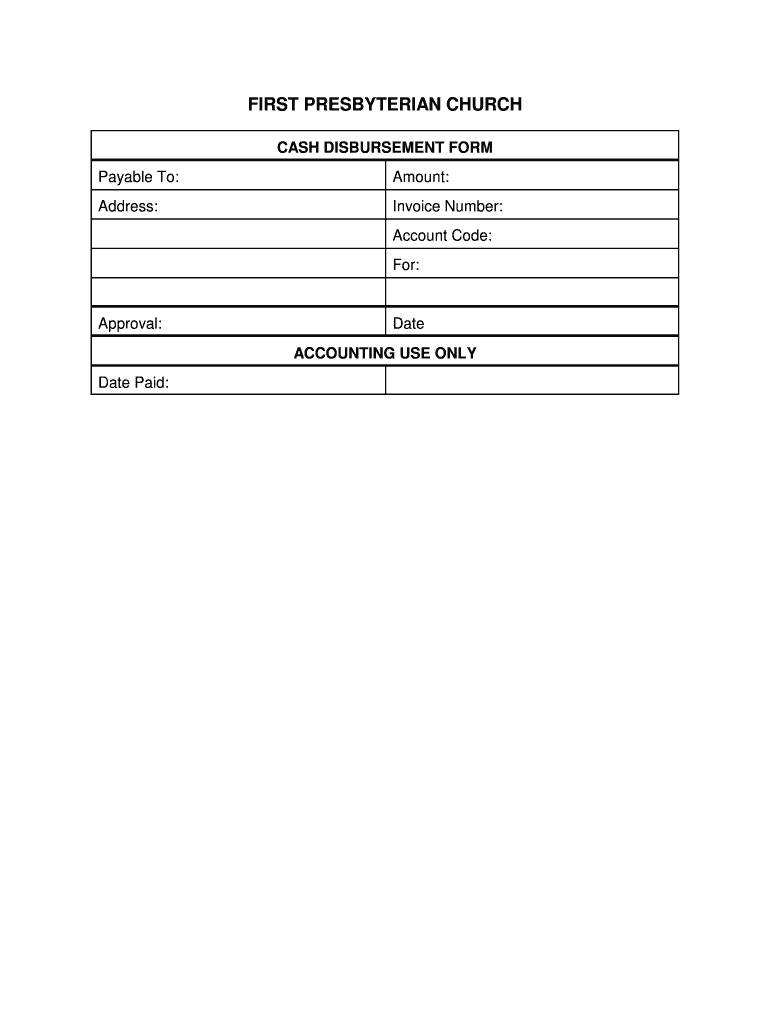

Book Confirmation getting Va Funds That have Reduced Ratings

Getting straight down credit scores towards Va and other variety of home mortgage, book otherwise mortgage record is very important. A previous housing record is a great signal from exactly how somebody will pay an alternate household percentage. Thus lenders need lease really positively. The absolute most weight is provided with to a lease history shown from the cancelled inspections. Following a purchaser demonstrating promptly commission records through inspections suggests the customer is certainly one who indeed made the fresh costs. And it reveals they were produced punctually and there’s no disputing this. Second, rent costs affirmed courtesy a rental company is an effective. The weakest could be rental money designed to an individual. In cases where costs are designed to somebody, more documentation may be needed. For-instance, terminated monitors otherwise evidence of withdrawal out of a checking account getting one year manage let.

Recall, playing with solution borrowing from the bank is not an effective way to skip an adverse credit history or score. Alternative borrowing from the bank try a means of proving a far more strong otherwise outlined percentage record compared to credit report suggests.

Va Mortgage Manual Underwriting Approval

Have a tendency to down fico scores suggest loan providers may not receive an automatic underwriting acceptance. Constantly automatic preapprovals are utilized just like the helpful tips having underwriting this new file. However, all the way down ratings or a recent major feel such as loans East Nicolaus foreclosure or bankruptcy proceeding might require tips guide underwriting. I have higher achievements in aiding consumers get approved which have minimal borrowing or reduced score. Hence yourself underwritten finance feel the pursuing the properties:

Have you been working with a realtor and discover you may need help being qualified, explore all of us. We are able to have a tendency to approve people for a Va loan whenever over a 600 rating. Although, the greater the get, the higher chance of recognition. So if you have limited credit, but could render adequate documentation above, contact us to try to get a beneficial Virtual assistant home loan acceptance. Develop this helps for the understanding the minimum credit history to own Virtual assistant financing conditions.

Secret to help you Timely Virtual assistant Mortgage Recognition Upwards-Top

We are going to demand the COE, condition report, done your application, and you will talk about their home loan choices. All of our goal is to try to features experienced, pretty sure, and you will acknowledged buyers!