It’s been throughout the two years once the graduating off Pharmacy College. I became signed up as the an effective Pharmacist in . This was a giant milestone in my lives. So it intended all of the my effort would in the long run shell out of. I found myself finally going to get one to six-figure paycheck you to definitely we focus on. It absolutely was a feeling of great fulfillment that we was in fact looking forward to throughout the the ages inside college or university. You to definitely impact although not, don’t last enough time once i become receiving age-mails regarding the figuratively speaking I had borrowed during university.

Yet I got accumulated around $85,000 dollars inside the education loan obligations with an effective 6.8% interest rate. Left-over on the student loans was about $20,000 cash for crisis loans however if I’m able to maybe not come across really works instantly. This might have been used to pay straight back a number of the financing instantaneously, yet not I got maybe not cemented a full time employment just like the an excellent pharmacist. Just after graduation We spent some time working 2 for each and every diem (on label) efforts until when my personal standing was made into full-time on among work.

A lot of my classmates become to acquire the fresh trucks, homes, and got fancy holidays once they come operating. There is certainly part of myself one desired to get in on the fun however, realized this will damage myself financially in the future. We hated the fact that this is this new poorest We have actually been in living. My web really worth is actually -$65,000 starting from school. This could have been a whole lot more if i had not started operating in the period of 14 which have part time jobs, internships, and you can june efforts. Interestingly, at period of twenty five graduating having a bachelors and doctorate education my personal internet really worth is actually lower than new-born babies!

How i Paid off Pharmacy University Funds in two ages

My personal next goal would be to eradicate my personal student education loans just that you could. New 6.8% interest was not anything I needed clinging more than my arms. While making some thing bad, student loan attention is not tax-deductible for many who hit a beneficial specific income peak. Thus, it just produces zero experience to store such financing to during the my circumstances. There is certainly an enticement to join my personal friends and increase my total well being. It requires abuse to avoid these types of temptations and get an easy method to love lifestyle without getting engulfed because of the consumerism.

The way i Paid down Drugstore School Financing in two years

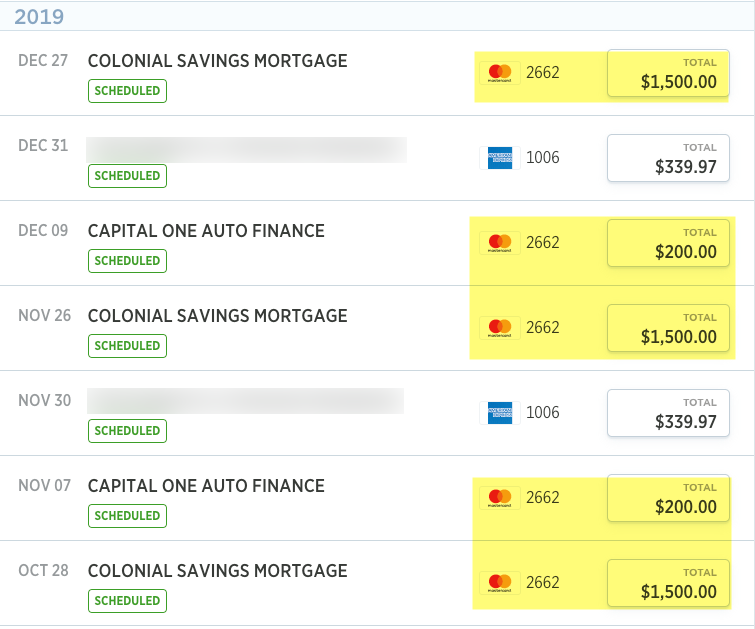

Over the last a couple of years We have authored a spending budget having exactly how my cash is invested. It allowed us to monitor in which my currency is actually going. The budget found where currency might possibly be stored. At some point, the program so you can finances and keep a cheap total well being aided repay my $85,000 education loan obligations within just a couple of years. Here are the secrets to settling the student education loans inside the a short length of time:

- Carry out a budget: Performing a monthly funds may help guide spending. Initial, a few days is going to be examined closely to locate a keen concept of in which cash is becoming invested.

- Monitor your own monthly income: this can be found in your finances. When you have several income streams it could be useful to store it independent regarding finances. You could potentially song if you find yourself generating or shorter through the the entire year. A good unit to possess overseeing funds and money move was mint otherwise personalcapital

- Maintaining brand new Joneses: Most people keep with the fresh new Joneses by buying the latest autos, the latest equipment, designer gowns, food during the fancy eating, to find extremely measurements of property, or going on high priced holidays. Yes these items is sweet however when you’re life style paycheck to help you salary and also debt that’s accruing interest.

- Living with the a comparable Finances just like cash advance Esto the an university student: You have currently got sense lifestyle as the a bad scholar. Carried on undertaking the same and conserve a giant section of one’s paycheck. This will allows you to create larger costs toward those people scholar financing.

- Create a week so you can biweekly financing money: Try to make payments into the a weekly or biweekly basis so you can ount of interest one produces into figuratively speaking. Example Education loan: $10,000. You will be making $step 1,000 money payments each week. To own 1 week you are going to accrue attract into the $10,000, seven days to your $nine,000, 7 days on $8,000, and you will seven days to your $7,000. Full attract with the few days might be high for people who made monthly installments and had twenty eight times of attention with the $ten,000 bucks.

- Select a 2nd For each Diem otherwise In your free time Jobs: One next jobs money commonly accelerate your repayments. Merely endure for one-a couple of years and this loan will be covered exactly that a lot faster!

- Including see my personal almost every other blog post from the Education loan Refinancing to keep money.

I really hope counsel significantly more than will help publication, motivate, and you may motivate you for success. Go after my personal web log to get more tips and advice towards profit and you may are a pharmacist. Just what are your own knowledge? Please comment below and you will express your opinions.