A giant percentage of mortgages could be handling the termination of its repaired label, leaving of several house paying 2-3 moments its newest fixed rates.

In this article, we are going to explain what to expect in the event the repaired interest rate closes and ways to prepare for they.

What will happen in the event the fixed rate mortgage finishes?

In the event your fixed name are nearing the end, you will need to determine whether to re also-boost the loan at an alternate rate, switch to a varying speed, or imagine using another type of mortgage vendor.

Otherwise do anything before the repaired identity lapses, towards the expiry your own financial merchant generally changes the loan to the fundamental adjustable price, that will be much higher than simply some of the deal selection offered to new clients.

The great thing to complete is get hold of your provider and get all of them regarding your selection, and additionally just what prices they can provide you with.

How-to get ready

Think reviewing your home loan no less than 3 months through to the repaired rates ends, since this will give you time and energy to apply transform if required.

It’s really worth speaking-to your current seller in advance discover out exactly what variable rates you’ll end up using. Thus giving your a way to here are some other cost available in the business and you can contemplate if changing providers try a great most readily useful solution.

It’s also possible to try to discuss a better rates because will get save you a lot of time when you look at the moving to a new provider.

Now’s a great time to see just how the loan piles against almost every other fund around. This should help you determine if you get an aggressive focus speed.

If you pick a far greater provide, switching company can be a sensible disperse. But it is crucial that you look at the will cost you involved in switching-credit can cost you and you can altering charges-because these could provide more benefits than advantages.

If you would like the new predictability that accompanies a predetermined-speed financing, you might refix your financial which have an upwards-to-day interest rate.

not, you’re locked into the this new fixed interest rate for a period loan places in Oklahoma of the loan title, if you don’t will avoid the fresh new bargain prior to that may results when you look at the break can cost you.

Make sure you in addition to carefully take a look at the attributes of an excellent fixed mortgage as well, such as for instance commission-free additional costs, redraw and you can linked offset profile. Of numerous fixed speed fund do not give these characteristics.

When you’re not able to determine ranging from a changeable otherwise repaired speed, or if perhaps you’re keen on a mixture of autonomy including certainty, you could choose to has actually part of your financial fixed and you will element of it adjustable.

This process offer the very best of both planets. The fresh varying rates part will provide you with autonomy, as the fixed bit shelters part of the loan from rising interest rates.

If you can’t decide which choice is good for you, a mortgage pro is able to direct your on the right guidelines.

Financial experts will look at the money and you may recommend a number of the best mortgage choices to suit your certain requires. They are going to be also in a position to guide you because of using a special merchant if that is the trail you choose to bring

- pick a means to okay-song the loan

- attract more certainty otherwise independency into the interest rate selection

- reduce your costs

- pay-off the loan fundamentally.

In case it is simple for that take action, think paying as frequently of your own financial as possible just before you’re hit with a higher rate of interest.

By eliminating your financial harmony prior to the rate of interest increases, you can save your self tons of money on appeal payments before they actions with the the new rate.

Ideas on how to carry out large repayments

If the fixed mortgage price concludes, as well as your costs start expanding, your money may prefer to feel analyzed to cope with new the fresh fact away from ascending interest rates.

- providing trains and buses to work to reduce fuel costs and you will vehicle parking

- shopping on the internet designs

- high priced memberships you never regularly play with

- taking advantage of regulators and you may council rebates to minimize your power bill

- switching to energy conserving products and you will lightbulbs

- examining the power and insurers-there could be best income to be had which could help you save a lot of money.

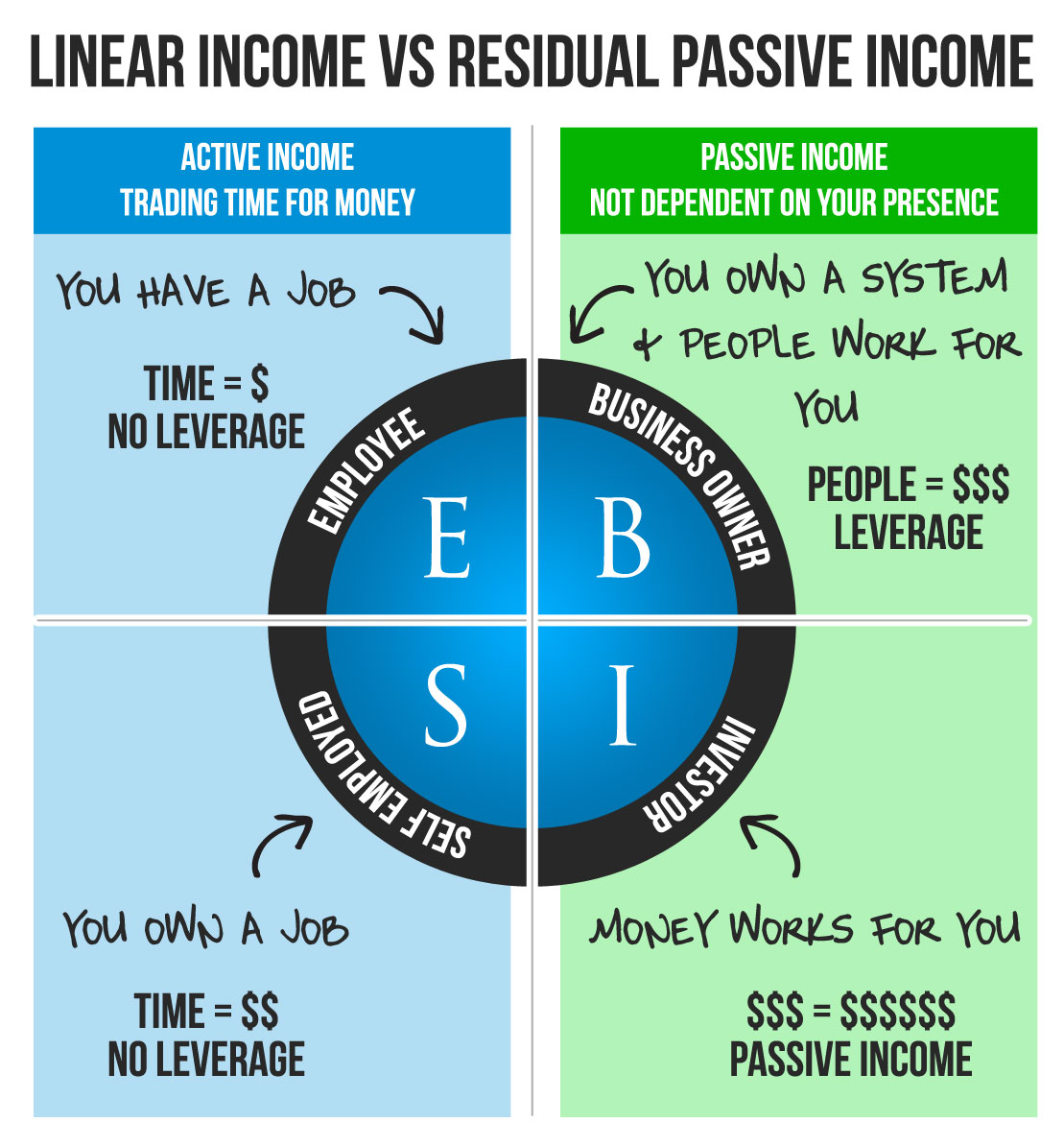

You might like to think starting a part hustle for example puppy taking walks otherwise on the web tutoring to make extra cash. Another option is to rent a bedroom or parking room.

A counterbalance account feels like a great transactional savings account about your financial harmony. The amount of money contained in this account can reduce the amount of appeal you only pay on your home loan, so holding their discounts right here is going to be of good use.

Such, when you yourself have a beneficial $600,000 home loan balance and you can $100,000 on your own offset membership, you can simply be billed attention towards the $five hundred,000.

This file has been made by IOOF Funds Choice Pty Ltd ABN 74 129 728 963 ACL 385191 (IOOF Finance Options). The information within this document includes general advice merely and you can does maybe not take into account debt activities, requires and you can expectations. Prior to making one decision predicated on which file you will want to determine the things or talk with your financial adviser. It’s also advisable to receive and envision a copy of one’s related Device Disclosure Statement before you can and acquire an economic unit to choose if it is best for you. Whenever you are IOOF Fund Choice has taken all reasonable worry during the promoting the information contained in this file, IOOF Finance Options helps make zero representations according away from, and you will, towards the the amount allowed for legal reasons, excludes all of the warranties in relation to the precision otherwise completeness out-of everything. IOOF Funds Options, the officers, group, directors and you may builders exclude, towards restriction the quantity allowed for legal reasons, all the liability whatsoever for your losses otherwise wreck howsoever developing out out of reliance, entirely or perhaps in part, to the pointers inside document.