USDA Fund Data

![]()

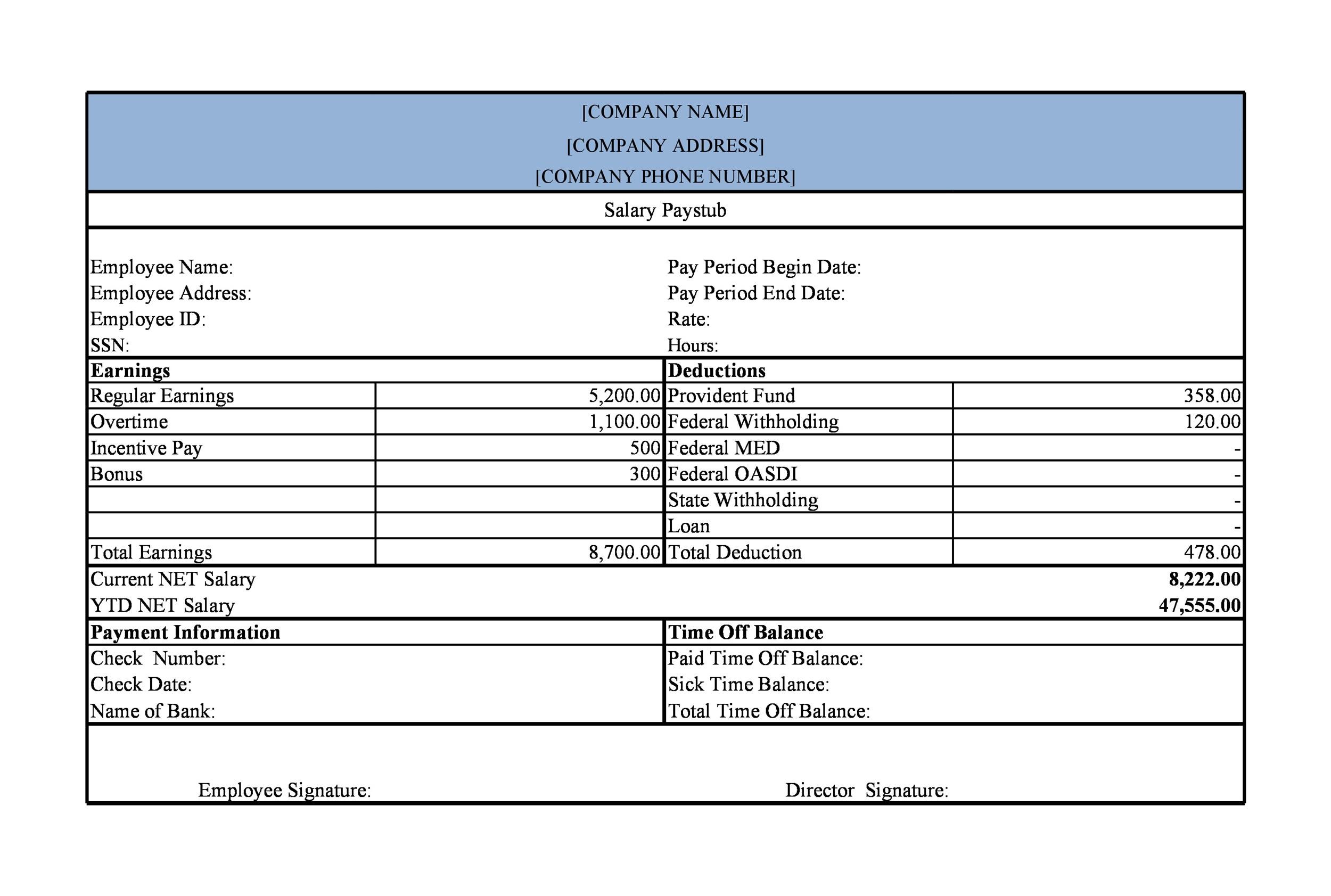

The most amount borrowed computation is performed centered on all offered historical studies, and it also has the present day spend stubs including W2s. Yet not, the newest USDA possess lay its earnings maximum, and it is determined just before deductions are produced from this new payroll. Gross income is actually an expression of any bonuses, paycheck, information, commission, overtime, as well as solution compensation; additionally is living allowances rates or even the construction allocation received.

If you reside within a family in which a part is a character otherwise they own a small business, there’s now the aid of net gain out of procedures. Simultaneously, loan providers likewise have their specific advice and that revolve as much as work and you may money.

All the fund are susceptible to underwriting or investor acceptance. Most other constraints get apply. This is simply not an offer regarding borrowing or an union so you can provide. Advice and you may products are subject to alter.

Approval Processes for USDA loan

Brand new USDA Mortgage Approval Techniques getting a good USDA mortgage for the Texas begins with calling an approved USDA Financing Private Bank. Recognized USDA Mortgage Personal Loan providers try backed by the united states Institution from Agriculture but never in fact offer you the house loan on their own.

Benefits of a beneficial USDA loan

The benefit of a texas USDA Loan gets secured to your a thirty-season mortgage having a minimal repaired interest rate and potentially zero down payment specifications. If you don’t have a downpayment, you’re going to have to pay a premium for financial insurance rates payday loans without bank account in Ponce De Leon so you’re able to mitigate the fresh new lender’s risk.

USDA financing benefits and drawbacks

Furthermore, no cash reserves are crucial. This will help you order a property reduced without having a lot of cash secured about lender.

The credit and you will qualifying assistance is versatile, that also makes it easier to be eligible for capital, even if your credit report, declaration, and you will results is actually because the best because they would need feel to possess antique otherwise commercial resource.

A separate perk associated with the program would be the fact it can be put upwards therefore the seller pays brand new closing costs. Having less prepayment punishment and you may lowest repaired interest rates is a couple significantly more provides you to help you save money. You are able to make use of this mortgage to invest in closing costs and you may solutions straight into the mortgage.

The overall flexibility of your system is really so versatile that you are able to use this one to own building a home, purchasing a property, if you don’t merely refinancing that. The application assists Agricultural Brands having Doing work Finance to aid loans Agriculture Operations. Such Doing work Money lend guidance to possess producers to view high quality places.

For one, you will find geographical restrictions. Even though many Texans meet the criteria on system, it is mainly based way more on the rural and you will suburban homes, so those surviving in very cities might not qualify. Fortunately, discover online learning resources where you can just plug regarding the physical address of any land to determine most likely eligibility.

Next, you can find income limits. If you or your family renders money excessively of your system limits, you do not qualify for direction or experts.

Third, mortgage insurance is constantly as part of the loan. At the same time, it’s good to get that coverage, and you may truthfully essential to begin by. But not, pressed addition on the mortgage you are going to prevent you from doing your research for your own personel insurer preference.

Next last but most certainly not least, it mortgage and you can program you should never qualify for duplex homes. Applicable residences can simply end up being solitary-members of the family equipment. And, they must be owner-filled, you cannot make use of these positives for flips, leases, or trips residential property.